The Palari Group is developing a large planned community of 94 contemporary homes within an exclusive 30-acre gated community in La Quinta, an affluent neighborhood in the Coachella Valley. Located between Indian Wells and Indio, the La Quinta development will feature mid-century modern homes placed on expansive 10,000-sq.ft. lots featuring a swimming pool, pool cabanas, hot tubs, fire pits and outdoor showers.

The Palari Villas are built with sustainability as its core principle as the homes are 3D printed using the latest in robotics and feature solar panels, electric car chargers, back-up batteries, gray water filtration systems and drought tolerant landscaping. La Quinta promises all its residents the perfect combination of luxury in a prime location with easy access to America’s finest golf, spa and dining venues in the heart of the Palm Springs Valley. Homes will be ready for residents to move in by Q2, 2024.

Thinking about a Palari Villa as an investment property?

Purchasing a Palari Villa as a rental property is an excellent way to earn passive income. The home can be rented out on either a long-term or short term basis (vacation home), although the latter has several benefits you may not have considered, including the following:

- Maximizing Profit – The income generated from a short term rental is generally 2-3X higher than long term rentals.

- Easily & Professionally Managed – No effort is required on your end. We have contracts with professional 3rd party management companies that will make sure your property is well maintained and properly managed when you’re not using it yourself. We have partnered up with the world’s largest vacation rental management company who has a successful track record in maximizing profit for homeowners.

- Flexibility Allowing For Personal Use – You can enjoy the home yourself whenever you want! Block off some vacation time with your family or friends and come enjoy!

- Minimal Competition – Palari Villas are located in regions which do not allow vacation rentals to exist outside of master-planned communities that specifically allow for such use. This means the pool of competing properties has decreased dramatically.

During inflationary times, real estate has historically been one of the best hedges as home prices tend to keep up with the rising cost of living. Real estate allows you to diversify your portfolio and own tangible assets which are considered safer and more stable in comparison to other asset classes such as stocks and bonds. Vacation rentals can pay for themselves, provide a passive income stream, and appreciate in value over time.

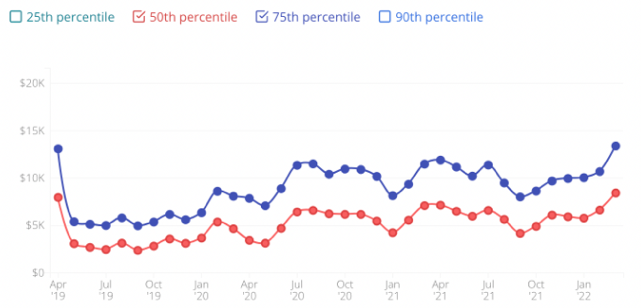

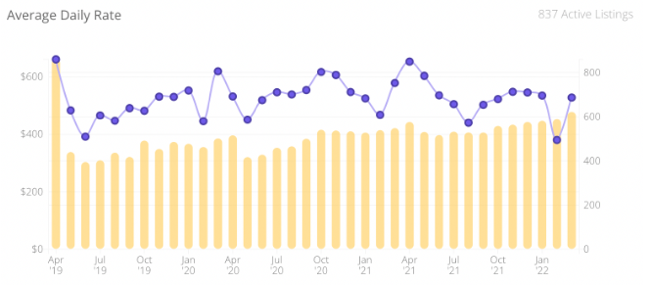

Short-Term Rental Market Data via AirDNA

La Quinta | 3-Bedroom Comparable Rental Properties | March 2022

- Median monthly revenue (total nightly rate + cleaning fees) ranging from $8,400 to $13,400

- Average Daily Rate of $518 with occupancy levels above 85%

Our La Quinta Site is a QOZ: “Qualified Opportunity Zone”

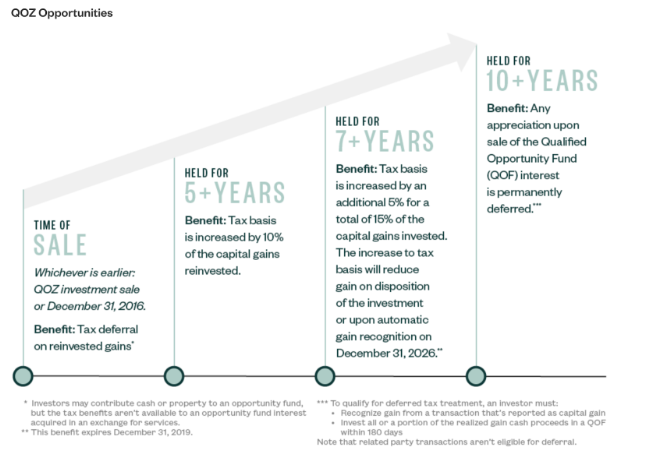

Our community in La Quinta is located within a (QOZ) Qualified Opportunity Zone where investments under certain conditions are eligible for multiple tax benefits. Specifically, Opportunity Zones provide an opportunity for investors to defer federal capital gains when held until 2026 and prevent any capital gains tax if their investment is held for 10 years or more. This is a unique opportunity to invest in a highly profitable asset class and one of the best inflation hedges in our current economic environment.

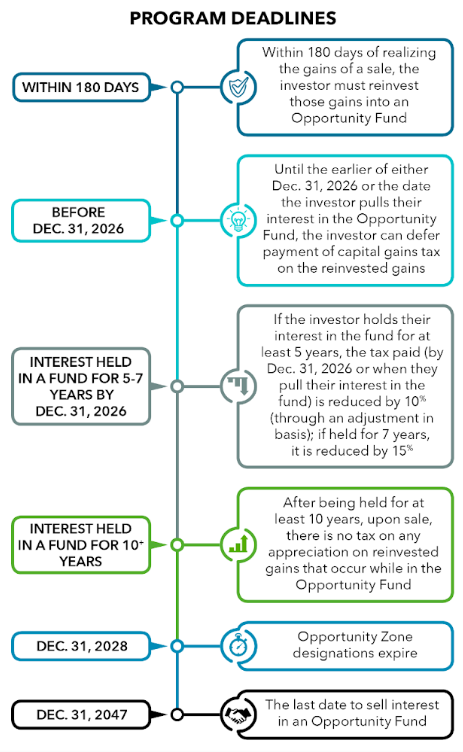

- In order to qualify, capital gains must be invested in an Opportunity Zone within 180 days of earnings those gains (not simply pledged as a future commitment). These gains are then tax-deferred to 2026. In settling those taxes, the capital gain’s original tax attribute will be preserved throughout the deferral period.

- For a new Opportunity Zone investment in which your capital gains were rolled into,

- the tax paid on it is reduced by 10%;

- if the investment is held for 7 years, it is reduced by 15%.

- there is no capital gains tax if the investment is held for 10 years

* Please speak to your accountant or CPA to make sure your capital gains qualify for these investment benefits.